Table of Contents

Why Are WooCommerce Payments, Invoices, and Taxes Often a Nightmare for Online Entrepreneurs?

Have you ever felt dizzy managing WooCommerce payments, various WooCommerce payment methods, or even confused by the message “this is only an estimate. prices will be updated during checkout.” that often appears? If so, you are not alone. For many online store owners / business services that require website transactions, managing financial aspects like invoices and taxes in WooCommerce can be a nightmare that consumes time and energy. In fact, your time should be focused on growing your business, not getting stuck in complicated administration.

Don’t let administrative complexity drain your potential profits. In today’s competitive market, operational efficiency is no longer an option, but a necessity. With a smooth checkout process and an automated invoice system, you not only increase customer satisfaction, but also ensure compliance with evolving tax regulations. Now is the time to switch from time-consuming manual processes to smart automated solutions.

Imagine how much time and resources you could save if sales invoices could be created and sent automatically, or if tax calculations were no longer a puzzle. Having full control over your WooCommerce custom invoice and WooCommerce tax settings means less stress, fewer errors, and more time for your business growth strategy.

This article will thoroughly explore how you can overcome these challenges. We will discuss the importance of efficient payment management, creating professional WooCommerce custom invoices, and navigating WooCommerce tax settings with ease. Get ready to discover smart solutions that will change the way you manage your online store, and ultimately, help you generate more money.

Understanding the Essence of WooCommerce Payments and Efficient Payment Methods

As the most popular eCommerce platform in the world, WooCommerce offers extraordinary flexibility in terms of payments. However, with many options, confusion often arises. Choosing the right WooCommerce payment methods is key to reducing payment friction and increasing conversions.

Various WooCommerce Payment Options: Which is Best for Your Business?

WooCommerce supports various payment methods, from traditional to modern:

- Direct Bank Transfer: A simple basic method, but requires manual confirmation.

- Cash on Delivery (COD): A popular option in some regions, especially for customer convenience.

- Payment Gateways: These are the core of efficient online payments. Examples include:

- PayPal: A trusted global solution.

- Stripe: Popular for its ease of integration and support for many credit cards.

- Midtrans/Doku/Xendit (for the Indonesian market): Important for serving local customers with their preferred payment methods (e.g., e-wallet, virtual account).

Choosing the right method is not just about availability, but also about customer experience. The easier it is for customers to pay, the more likely they are to complete a transaction. Avoid displaying too many confusing options, but make sure your target audience’s favorite options are available.

Overcoming “This is Only an Estimate”: Price Transparency at Checkout

The message “this is only an estimate. prices will be updated during checkout.” often appears due to tax configurations or shipping costs that depend on location or other specific details that can only be accurately calculated at checkout. Although intended for transparency, this message can cause doubt or even disappointment if the final price differs significantly from the estimate.

How to Minimize Price Confusion at Checkout

To provide a smooth checkout experience and eliminate customer concerns, consider these points:

- Clear Tax Configuration: Make sure your WooCommerce tax settings are correctly configured from the start. We will discuss this in more detail later.

- Shipping Options: If shipping costs vary greatly, provide a clear estimate or use a courier service that provides an accurate estimate upfront.

- Complete Product Information: Explain all additional costs (if any) directly on the product page. Transparency is key.

With proper handling, the message “this is only an estimate. prices will be updated during checkout.” can be minimized or explained well, so customers feel more comfortable and confident when shopping.

Mastering WooCommerce Taxes Settings: A Complete Headache-Free Guide

Tax is one of the most complicated aspects of running an online business. Errors in configuring WooCommerce tax settings can be fatal. However, with the right understanding, you can manage it with confidence.

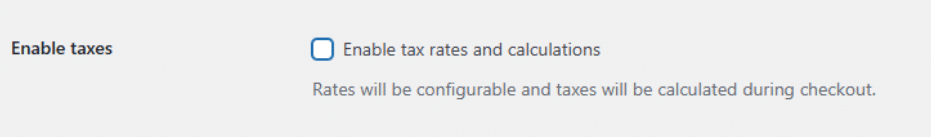

Basic Tax Configuration in WooCommerce

Enable Tax: The first step is to enable tax calculation in WooCommerce > Settings > General. Check the “Enable tax rates and calculations” option.

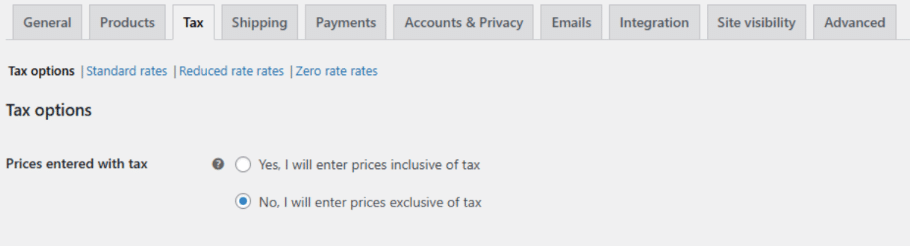

Set Tax Options: In the Tax tab, you will find various options such as:

-

- Prices Entered With Tax: Determine whether product prices include tax or not. This is crucial to prevent the unwanted “this is only an estimate. prices will be updated during checkout.” message.

- Calculate Tax Based On: Choose customer’s address (shipping or billing) or your shop’s address.

- Additional Tax Classes: Create different tax classes if you have products with different tax rates (e.g., digital vs. physical products).

Add Tax Rates: This is the most important part. Under the Tax tab, click “Standard Rates” or any other tax class you created. You can add:

-

- Country Code: For country-specific tax rates.

- State/Province Code: For regional tax rates.

- Tax Rate (%): The applicable taxes percentage.

- Tax Name: (e.g., VAT, GST).

- Shipping: Determine whether tax also applies to shipping costs.

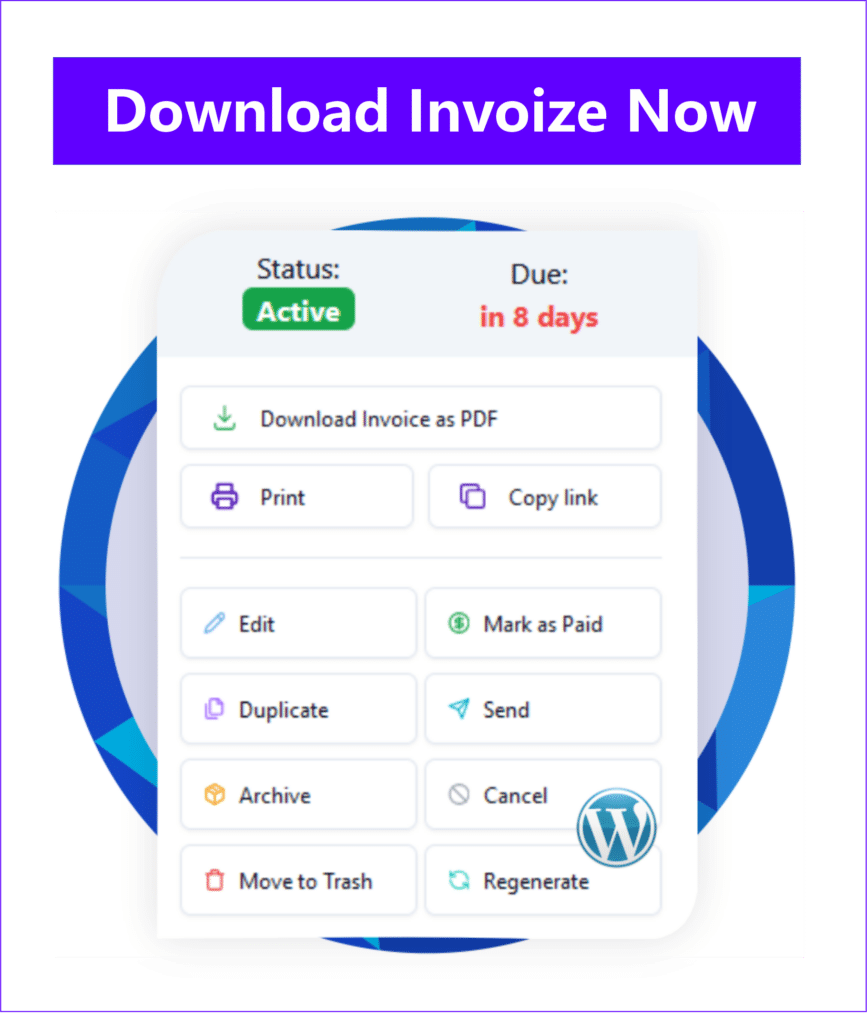

Creating Automatic WooCommerce Custom Invoices: Professionalism Without the Hassle with Invoize

Creating professional invoices is a reflection of an organized business. However, doing it manually for every transaction is certainly tiring. This is where automatic WooCommerce custom invoices play a big role. With Invoize, you can create attractive, informative invoices that are automatically sent to customers after purchase.

Benefits of Invoices Automation with Invoize

- Time Efficiency: No need to create invoices one by one. Invoize will do it for you.

- Professionalism: Send clean, neat invoices that match your store’s branding. You can add your logo, contact information, and special notes.

- Accuracy: Reduces manual errors in calculations and data.

- Customer Satisfaction: Customers get instant proof of transaction, increasing trust and transparency.

- Tax Compliance: Structured invoices facilitate record-keeping for tax purposes.

Featured Invoize Features for Automatic Invoicing

Invoize offers various advanced features specifically designed to meet your WooCommerce store’s invoicing needs:

- Custom Invoices Templates: Create unique invoice designs that match your brand identity. (Example: Choose from various ready-to-use templates or design your own with a drag-and-drop builder.)

- Automatic Delivery: Set invoices to be sent automatically after an order is completed, or at a specific order status.

- Complete Tax Information: Automatically pulls tax data from your WooCommerce tax settings and displays it correctly on the invoice.

- Multi-Currency Support: If you sell to multiple countries, Invoize can display invoices in the relevant currency.

- Easy Integration: Just a few clicks to integrate Invoize with your WooCommerce store.

With Invoize, invoice management is no longer a burden, but an asset that strengthens your business’s professional image.

Tips for Managing Taxes with Invoize

Although WooCommerce provides basic settings, managing complex taxes (e.g., for international sales with different tax rules) can be challenging. Invoize can help simplify this process by:

- Data Tax Integration: Pulls tax data directly from your WooCommerce settings to ensure invoices are always accurate.

- Automatic Tax Reports: Generates necessary reports for tax filing, saving time and reducing potential errors.

- Automatic Updates (if relevant): Some advanced invoice plugins can even help monitor global tax rate changes, ensuring you are always compliant.

Understanding and correctly configuring your WooCommerce tax settings is a critical foundation for the legality and profitability of your online business.

Conclusion: Increase Productivity and Profit with an Integrated Solution

Managing WooCommerce payments, choosing the right WooCommerce payment methods, overcoming “this is only an estimate. prices will be updated during checkout.”, creating WooCommerce custom invoices, and navigating WooCommerce tax settings may sound complex. However, with the right tool like Invoize, all of this can become easier, more automatic, and more efficient.

Don’t let administration hinder your business growth. Invest your time focusing on sales strategies and customer satisfaction, and let Invoize handle the technical details of invoicing and payments. With an automated system, you will not only save time, but also increase business professionalism, build customer trust, and ultimately, generate more profit.

Contact Us

Support: If you have any questions, need assistance, or would like to share feedback, you can click here.

Author

-

Hi, I'm Dede Nugroho. I enjoy sharing what I know with others. I'm passionate about security and have experience developing WordPress plugins

View all posts