Table of Contents

In today’s fast-paced digital economy, managing finances efficiently is paramount for any business, especially those operating on WordPress or WooCommerce. If you’re still wrestling with manual invoicing, chasing late payments, or struggling to keep your financial records organized, it’s time to consider a dedicated invoice plugin. This essential tool transforms your billing process from a tedious chore into a streamlined, automated operation, freeing up valuable time and ensuring a healthier cash flow.

A robust WordPress invoice plugin isn’t just about generating documents; it’s about creating a seamless financial ecosystem within your website. From one-click invoice creation to automated payment matching and smart reminders, the right solution can significantly reduce administrative burden and accelerate your payment cycles. Let’s explore how integrating an invoice plugin can revolutionize your business operations and set you on the path to greater financial efficiency.

Understanding WordPress Invoice Plugins: Essential Tools for Businesses

What is an invoice plugin and its core function?

At its heart, an invoice plugin for WordPress is a software extension designed to automate and manage the entire invoicing process directly from your website. Instead of relying on external software or manual spreadsheets, this plugin integrates seamlessly with your WordPress or WooCommerce store, allowing you to create, send, and track invoices with ease. Its core function is to generate professional, legally compliant invoices for goods sold or services rendered, ensuring that your clients receive clear and accurate billing documents.

How these plugins streamline billing and financial processes

The primary benefit of an invoice plugin lies in its ability to streamline your billing and financial processes. Imagine generating an invoice in one click directly from an order or quote within your WooCommerce store. This eliminates manual data entry, reduces errors, and significantly speeds up the time it takes to bill a client. Beyond creation, these plugins automate sending invoices via email or even WhatsApp, ensuring timely delivery. They also play a crucial role in tracking payment statuses, sending automated reminders for overdue invoices, and even matching incoming payments to outstanding bills, drastically cutting down on administrative busywork.

Benefits for various business types using WordPress

An invoice plugin offers immense benefits across a spectrum of business types:

- E-commerce Stores (WooCommerce): Automatically generate invoices for every sale, manage refunds, and track order payments.

- Freelancers & Consultants: Easily create professional invoices for services, track billable hours, and manage recurring client retainers.

- Service Providers: Automate billing for subscriptions, memberships, or project-based work, ensuring consistent cash flow.

- Small to Medium Businesses: Centralize financial records, improve payment collection rates, and gain better insights into financial performance.

Regardless of your business model, if you’re using WordPress, an invoice plugin is an indispensable tool for maintaining financial health and operational efficiency.

Why Your WordPress Site Needs a Dedicated Invoice Plugin

Saving time and reducing manual errors in billing

One of the most compelling reasons to adopt a dedicated invoice plugin is the significant time savings and reduction in manual errors it offers. Manual invoicing is not only time-consuming but also prone to human mistakes, such as incorrect amounts, wrong client details, or missed invoices. An automated system eliminates these risks. When an invoice can be generated from an existing order with a single click, the process becomes instantaneous and error-free. This automation extends to sending invoices, tracking their status, and even reconciling payments, allowing you and your team to focus on core business activities rather than administrative overhead.

Enhancing professionalism and building client trust

Professionalism is key to building and maintaining client trust. A high-quality invoice plugin allows you to create polished, branded invoices that reflect your business’s identity. Customizable templates ensure that every invoice sent is consistent, clear, and professional, reinforcing your brand image. When clients receive well-organized, accurate invoices promptly, it signals reliability and attention to detail. This professionalism extends to offering convenient payment options, including local payment methods, which further enhances the client experience and fosters stronger relationships.

Ensuring compliance and accurate financial record-keeping

Accurate financial record-keeping is not just good practice; it’s a legal and regulatory requirement for businesses everywhere. A robust invoice plugin helps ensure compliance by generating invoices that adhere to standard accounting principles and often support various tax calculations, such as VAT or GST, depending on your region. It provides a centralized, digital record of all transactions, making it easier to track income, manage expenses, and prepare for tax season or audits. With features like automatic payment matching, you can maintain precise records of what has been paid and what is still outstanding, giving you a clear and current financial overview of your business.

Crucial Features to Seek in a WordPress Invoicing Solution

Automated invoice generation and scheduled sending

The cornerstone of any effective invoice plugin is its ability to automate. Look for solutions that can automatically generate invoices upon order completion, quote acceptance, or at predefined intervals. The power to schedule invoice sending means you can set it and forget it, ensuring clients receive their bills on time, every time. This feature is particularly valuable for businesses with recurring services or subscription models, as it guarantees consistent billing without manual intervention.

Customizable templates and branding options for invoices

Your invoices are an extension of your brand. A top-tier plugin will offer extensive customization options for invoice templates. This includes adding your company logo, choosing fonts and colors, and arranging layout elements to match your brand identity. Professional, branded invoices not only look good but also reinforce your business’s credibility and professionalism with every transaction.

Seamless integration with popular payment gateways

Getting paid quickly and conveniently is crucial. The best invoice plugins integrate seamlessly with a wide array of popular payment gateways. This allows your customers to pay directly from the invoice using their preferred method, including credit cards, bank transfers, and crucially, local payment methods specific to their region. Automatic payment matching via webhooks is a game-changer, instantly reconciling payments with invoices and reducing manual tracking.

Recurring billing and subscription management capabilities

For businesses offering subscription services, memberships, or retainer agreements, recurring billing is a must-have. A powerful invoice plugin will automate the creation and sending of recurring invoices, managing subscription cycles, and even handling prorated billing or upgrades/downgrades. This ensures a steady and predictable revenue stream with minimal administrative effort.

Comprehensive reporting and analytics for financial insights

Beyond just creating invoices, a valuable plugin provides insights into your financial health. Look for features that offer comprehensive reporting and analytics, such as:

- Revenue tracking: Monitor income over time.

- Outstanding invoices: Quickly identify unpaid bills.

- Payment trends: Understand when and how customers pay.

- Tax reports: Simplify tax preparation with aggregated data.

These insights empower you to make informed business decisions and forecast future cash flow more accurately.

Multi-currency and robust tax calculation support

Operating in a global marketplace or even within diverse local economies requires flexibility. An excellent invoice plugin will support multi-currency options, allowing you to bill clients in their local currency. Furthermore, robust tax calculation support is essential. This means the plugin can handle various tax rates (e.g., VAT, GST, sales tax) based on customer location, product type, or specific regional regulations, ensuring compliance and accuracy in your financial documents.

Top WordPress Invoice Plugins: A Comparative Analysis

When searching for the ideal invoice plugin for your WordPress or WooCommerce site, you’ll encounter a range of options, from free basic tools to comprehensive premium solutions. Understanding the general landscape and what each type offers is key to making an informed decision without getting bogged down in specific product names.

Review of popular free invoice plugin options

Free invoice plugins often serve as an excellent starting point for small businesses or freelancers with basic invoicing needs. They typically provide core functionalities such as:

- Basic invoice generation from orders.

- Simple PDF invoice creation.

- Limited customization options for templates.

- Manual sending via email.

While these plugins can handle the essentials, they often lack advanced features like automated payment reminders, multi-currency support, or deep integration with payment gateways. They might require more manual oversight and could become restrictive as your business grows.

Evaluation of leading premium invoicing solutions

Premium invoice plugins, on the other hand, offer a far more robust and feature-rich experience. These solutions are designed to handle the complexities of growing businesses and provide a complete financial management ecosystem. Key features often include:

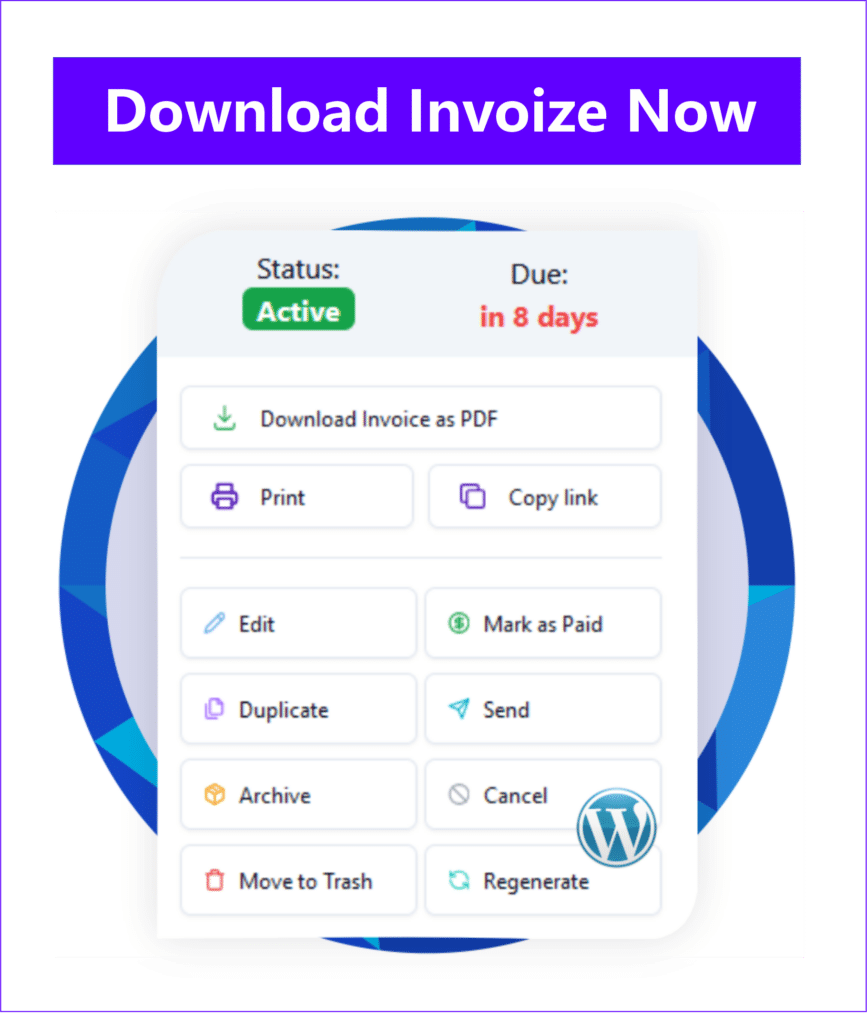

- One-click invoice creation: Generate invoices instantly from orders or quotes.

- Advanced automation: Scheduled sending, smart payment reminders, and automatic payment matching.

- Extensive customization: Fully branded templates, professional designs.

- Broad payment gateway support: Integration with global and local payment methods.

- Recurring billing: Comprehensive subscription and membership management.

- Detailed reporting: Financial insights, tax reports, and cash flow analysis.

- Multi-currency and tax compliance: Support for various currencies and complex tax regulations.

- Dedicated support: Access to expert assistance for setup and troubleshooting.

These premium options are built to save significant time, reduce errors, and accelerate cash flow, making them a worthwhile investment for businesses serious about optimizing their financial operations.

Key differentiators and ideal use cases for each plugin

The main differentiators between various invoice plugins often boil down to their feature set, ease of use, and scalability. Free plugins are ideal for:

- New businesses with very low transaction volumes.

- Users who are comfortable with manual processes for some tasks.

- Those testing the waters of automated invoicing before committing to a paid solution.

Premium solutions are best suited for:

- E-commerce stores (WooCommerce) with regular sales.

- Service-based businesses with recurring clients or complex billing.

- Businesses needing to accept diverse local payment methods.

- Companies aiming to significantly reduce administrative busywork and improve cash flow.

- Any business prioritizing professionalism, compliance, and detailed financial insights.

Ultimately, the “best” plugin depends on your specific business needs, budget, and growth trajectory. Prioritize features that directly address your pain points and support your long-term financial goals.

Choosing the Right Invoice Plugin for Your WordPress Business

Assessing your specific business needs and budget

Selecting the perfect invoice plugin begins with a clear understanding of your business’s unique requirements. Start by asking yourself:

- How many invoices do you generate monthly?

- Do you offer recurring services or subscriptions?

- Do you need to accept local payment methods or bill in multiple currencies?

- What level of automation do you require for sending reminders and matching payments?

- What is your budget for a premium solution, or are you looking for a free option to start?

By outlining these needs, you can filter out plugins that either offer too little or too much, ensuring you invest in a solution that truly fits.

Considering scalability and future growth potential

Your business is likely to grow, and your invoice plugin should be able to grow with it. A solution that works for 10 invoices a month might buckle under the pressure of 100 or 1000. Look for plugins that offer:

- Robust performance: Can handle increasing transaction volumes without slowing down your site.

- Feature expansion: Offers advanced features you might need in the future, such as CRM integration or more sophisticated reporting.

- Developer support: Indicates ongoing development and compatibility with future WordPress and WooCommerce updates.

Choosing a scalable plugin prevents the headache of migrating to a new system down the line.

Importance of user-friendliness and reliable support

Even the most feature-rich plugin is useless if it’s difficult to use. Prioritize solutions with an intuitive interface that makes creating, sending, and managing invoices straightforward. A user-friendly design reduces the learning curve and minimizes the chances of errors. Equally important is reliable customer support. Should you encounter any issues or have questions, knowing that expert help is readily available can save you significant time and frustration. Look for plugins that offer comprehensive documentation, active community forums, and responsive support channels.

Step-by-Step Guide to Setting Up Your WordPress Invoice Plugin

Installation and initial configuration of the plugin

Once you’ve chosen your preferred invoice plugin, the setup process is typically straightforward. First, install the plugin through your WordPress dashboard by navigating to ‘Plugins’ > ‘Add New’, searching for the plugin, and clicking ‘Install Now’ then ‘Activate’.

After activation, you’ll usually find a new menu item in your WordPress dashboard dedicated to the plugin. The initial configuration often involves:

- Company Details: Entering your business name, address, tax ID, and contact information.

- Branding: Uploading your company logo and setting default colors for invoices.

- Currency Settings: Defining your default currency and any additional currencies you might use.

- Tax Settings: Configuring default tax rates or rules relevant to your region (e.g., VAT, GST).

Take your time with these initial steps to ensure all your foundational information is accurate.

Creating your first professional invoice template

A key benefit of an invoice plugin is the ability to create professional, branded invoices. Most plugins come with default templates that you can customize. Navigate to the plugin’s template or design settings. Here, you can:

- Select a base template that best suits your style.

- Drag and drop elements to rearrange the layout.

- Adjust fonts, colors, and spacing to match your brand.

- Add custom fields if you need to include specific information on your invoices.

Always preview your template to ensure it looks exactly as you intend before saving it as your default. A well-designed template enhances your professionalism and reinforces your brand identity.

Automating invoice delivery and payment reminders

The real power of an invoice plugin comes from its automation capabilities. Configure your plugin to:

- Automatic Invoice Generation: Set rules for when invoices should be generated (e.g., immediately after a WooCommerce order is marked ‘completed’, or after a quote is accepted).

- Scheduled Sending: Define how invoices are delivered – typically via email, but some advanced plugins also support sending via WhatsApp. You can schedule immediate delivery or set a specific date.

- Smart Payment Reminders: This is crucial for reducing late payments. Set up automated reminders to be sent:

- A few days before the due date.

- On the due date.

- At regular intervals after the due date (e.g., 3 days overdue, 7 days overdue).

- Payment Matching: If your plugin integrates with payment gateways via webhooks, configure it to automatically match incoming payments to outstanding invoices, marking them as paid without manual intervention.

By automating these processes, you significantly reduce the time spent on administrative tasks and improve your cash flow.

Maximizing Efficiency with Automated Invoicing in WordPress

Integrating with CRM and accounting software for synergy

To truly maximize efficiency, consider how your invoice plugin can integrate with other critical business tools. Many advanced plugins offer integrations with Customer Relationship Management (CRM) systems and dedicated accounting software. This synergy means:

- CRM Integration: Client details from your CRM can automatically populate invoices, ensuring accuracy and saving data entry time. Invoice history can also be visible within your CRM, providing a holistic view of client interactions.

- Accounting Software Integration: Automatically sync invoice data, payments, and expenses with your accounting software. This eliminates manual data transfer, reduces errors, and ensures your financial records are always up-to-date for tax purposes and financial reporting.

These integrations create a powerful, interconnected ecosystem that streamlines your entire business workflow.

Leveraging recurring invoices for subscription services

For businesses built on subscription models, memberships, or ongoing service contracts, leveraging recurring invoices is a game-changer. An effective invoice plugin allows you to set up recurring profiles for clients, defining the billing cycle (e.g., monthly, quarterly, annually), the amount, and the payment terms. The plugin then automatically generates and sends these invoices on schedule, ensuring a consistent and predictable revenue stream. This automation not only saves immense administrative time but also significantly reduces the risk of missed billing cycles, contributing directly to a healthier cash flow.

Best practices for managing client payments and overdue accounts

Even with automation, proactive management of client payments and overdue accounts is essential. Here are some best practices:

- Clear Payment Terms: Ensure your invoices clearly state payment due dates and accepted payment methods.

- Offer Diverse Payment Options: Integrate with multiple payment gateways, including local payment methods, to make it as easy as possible for clients to pay.

- Automated Reminders: Utilize your plugin’s smart reminder feature to send polite, automated follow-ups before and after the due date. Customize the tone to be firm yet professional.

- Easy Payment Access: Ensure invoices include a direct link for online payment, reducing friction for your clients.

- Regular Review: Periodically review your outstanding invoices report to identify potential issues early and follow up personally if automated reminders aren’t yielding results.

- Incentivize Early Payment: Consider offering small discounts for early payment, or clearly state late payment fees (if applicable and legal in your region) to encourage timely settlement.

By combining robust automation with strategic oversight, you can significantly improve your payment collection rates and maintain a strong financial standing.

Key Takeaways & Next Steps

Implementing a dedicated invoice plugin for your WordPress or WooCommerce site is no longer a luxury but a necessity for modern businesses. It’s the most effective way to transform your billing process from a time-consuming burden into a streamlined, automated operation that directly contributes to your financial health.

By choosing a plugin that offers one-click invoice creation, supports local payment methods, automates payment matching, and sends smart reminders, you can drastically reduce busywork and accelerate your cash flow. The right solution enhances professionalism, ensures compliance, and provides invaluable financial insights, empowering you to focus on what you do best – growing your business.

Your Next Steps:

- Assess Your Needs: Determine your specific invoicing requirements, budget, and desired level of automation.

- Research Options: Explore premium invoice plugin solutions that align with your business size and growth ambitions, paying close attention to features like multi-currency support, payment gateway integrations, and customer support.

- Implement & Automate: Install and configure your chosen plugin, setting up automated invoice generation, delivery, and payment reminders to start reaping the benefits of a more efficient billing system today.

Author

-

Hi, I'm Dede Nugroho. I enjoy sharing what I know with others. I'm passionate about security and have experience developing WordPress plugins

View all posts