Table of Contents

Every successful online business on WordPress—whether it’s an e-commerce store or a membership platform—has one thing in common: a solid financial management system. However, many business owners get stuck in manual bookkeeping, which leads to confusion, payment disputes, and an unprofessional image.

If that sounds familiar, here’s the solution. This article will dive deep into why the WordPress Payment History Plugin is no longer just an option, but a vital asset for your business. We’ll explore how this plugin, combined with an automated WordPress invoicing system, can transform the way you manage your finances—making it more efficient, transparent, and intelligent.

The Hidden Financial Chaos Behind Your WordPress Site

Without the right system, financial management can easily become a blind spot that harms your business. Here are the most common problems:

-

Error-Prone Manual Bookkeeping: Recording every transaction in spreadsheets is time-consuming, tedious, and highly prone to human error.

-

Weak Payment Proofs: Struggling to provide valid payment evidence to customers can lead to confusion, disputes, and damaged trust.

-

Interrupted Cash Flow: Difficulty tracking who has paid and who hasn’t leads to overdue receivables and cash flow bottlenecks—making effective client billing difficult.

-

Tax Season Headaches: Gathering transaction proofs for tax reporting becomes a nightmare when your data is scattered and disorganized.

-

Blind Business Analysis: Without centralized payment logs, you lose valuable insights into sales trends, best-selling products, and customer behavior—making strategic decisions harder.

-

Unprofessional Image: Manually created invoices that are inconsistent or sent late can harm your professional reputation.

The Foundation: Why the WordPress Payment History Plugin Is a Vital Asset

This is where the real solution begins. The WordPress Payment History Plugin automatically records, stores, and organizes every transaction detail on your site. It’s more than just a list—it’s a comprehensive financial database that serves as the backbone of your business, often referred to as payment logs.

The main benefits of having organized payment logs:

-

Stress-Free Auditing and Reconciliation: With all transactions (amount, date, payment method, and status) automatically logged, you can perform accurate financial audits anytime.

-

Quick and Fair Dispute Resolution: In case of a payment conflict, you’ll have concrete proof at your fingertips—allowing for efficient resolution while maintaining customer trust.

-

Data-Driven Business Insights: Historical payment data is a goldmine of information. Analyze sales trends, peak purchase times, and customer preferences to sharpen your marketing strategy—especially useful for subscription billing.

-

Tax Compliance Made Easy: When tax season comes, there’s no need to panic. Simply export well-structured transaction data from the plugin and hand it to your accountant.

-

Enhanced Customer Service: With access to each customer’s payment history, your team can offer more personalized service, identify loyal clients, and recommend relevant products.

From Data to Professional Documents: Automating WordPress Invoices

Once you have a solid payment log, the next step is to turn that data into professional documents: invoices. Using an invoicing automation plugin is a logical move to boost efficiency.

Why is automated invoicing so important?

-

Save Massive Time: Stop creating invoices manually. The plugin will automatically generate and send professional PDF invoices for each successful transaction.

-

Boost Professionalism: Send invoices with consistent, branded designs that build trust and reinforce your business image.

-

Eliminate Human Errors: Automation ensures no more typos or mismatched payment details.

-

Simplify the Customer Experience: Customers can easily view and download their invoices directly from their account dashboard.

-

Efficient Billing Management: For subscription-based businesses, the plugin can send recurring invoices and automatic payment reminders, keeping your client billing smooth.

How to Choose the Right Plugin for Your Business

The market is full of options. To find the best one, consider these factors:

-

Integration: Make sure the plugin integrates perfectly with your platform—especially WooCommerce if you use it. Search for WooCommerce invoice plugins for optimal compatibility.

-

Key Features: Does it offer what you need—customizable PDF templates, automatic invoice numbering, proforma invoices, credit notes, or packing slips?

-

Ease of Use: Choose a plugin with an intuitive interface so you don’t waste time configuring it.

-

Support and Security: Ensure it has responsive support and regular updates to maintain security and compatibility.

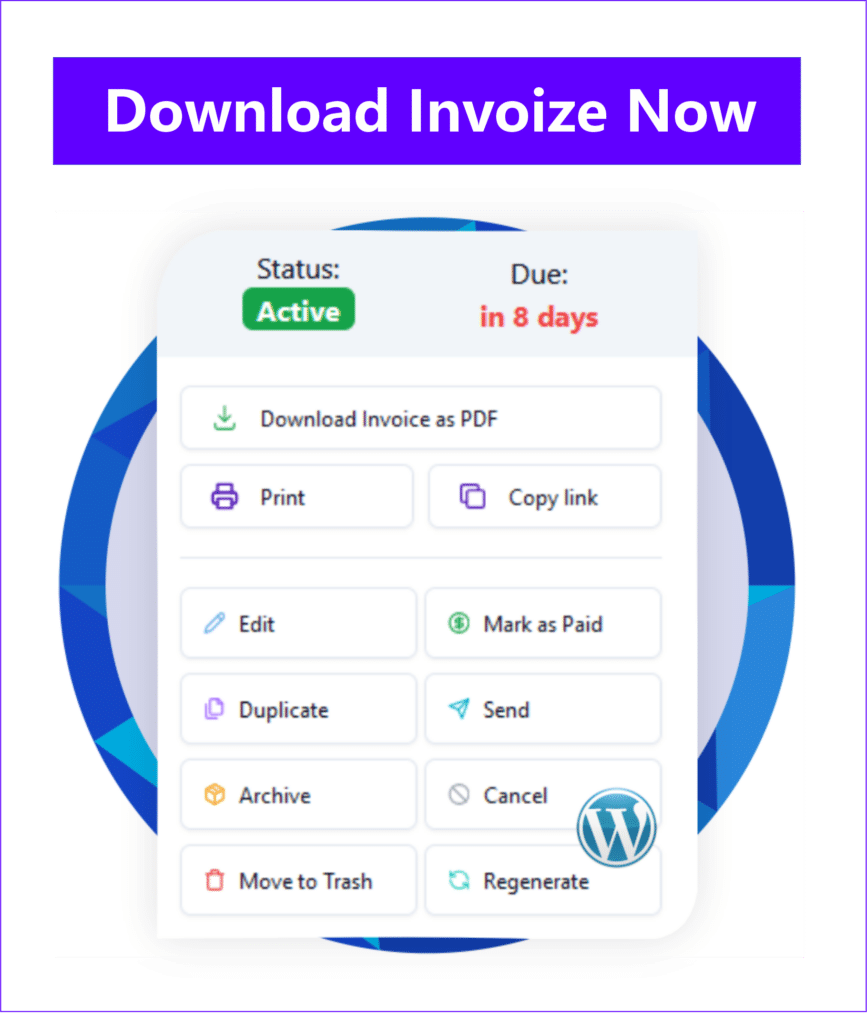

One strong and comprehensive example, especially for WooCommerce users, is Invoize. This premium plugin offers a complete invoicing solution, including automated invoices, proformas, credit notes, and fully customizable packing slips—ensuring every financial document looks professional.

Conclusion

Managing finances on WordPress doesn’t have to be complicated or time-consuming. By switching from manual bookkeeping to an automated system using the WordPress Payment History Plugin and WordPress Invoicing Solution, you’re making a smart investment for your business future.

You’ll not only save time and reduce errors but also build a stronger foundation for transparency, professionalism, and data-driven decision-making. Free yourself from administrative burdens and focus on what truly matters—growing your business.

Contact Us

Support: If you have any questions, need assistance, or want to share feedback, you can [click here].