Table of Contents

For any business operating on WordPress, managing finances efficiently is paramount. While your website handles sales and services, the process of billing clients and tracking payments often requires a separate, robust solution. This is where the ability to create professional invoice on WordPress directly from your dashboard becomes invaluable. Professional invoices not only ensure you get paid on time but also enhance your brand’s credibility and streamline your accounting processes.

Gone are the days of manual invoicing or relying on external software that doesn’t integrate with your site. With the right tools, you can generate, send, and manage all your invoices seamlessly within your WordPress environment. This guide will walk you through everything you need to know, from choosing the best plugin to customizing your invoices and automating your billing workflow.

Why Professional Invoicing is Crucial for Your WordPress Business

Are you wondering why investing time in professional invoicing matters for your WordPress-powered business? The benefits extend far beyond simply requesting payment. A well-structured, professional invoice is a powerful tool that contributes to your business’s overall health and reputation.

Enhancing Your Brand Image and Credibility

Every interaction a client has with your business reflects on your brand. A professional invoice, complete with your logo, brand colors, and clear details, reinforces your professionalism and attention to detail. It shows clients you are organized and serious about your business, fostering trust and making a lasting positive impression. Conversely, a poorly designed or generic invoice can undermine your credibility, suggesting a lack of professionalism.

Streamlining Financial Records and Accounting

Manual invoicing is prone to errors and can be incredibly time-consuming. By using a WordPress invoicing solution, you centralize your billing data. This makes it significantly easier to track income, categorize expenses, and prepare for tax season. Integrated systems often allow for quick generation of reports, providing a clear overview of your financial performance without tedious data entry.

Ensuring Timely Payments and Cash Flow

Clear, concise invoices reduce confusion for your clients, making it easier for them to understand what they owe and when it’s due. Professional invoices typically include:

- Clear payment terms: Due dates, accepted payment methods.

- Detailed breakdown: Itemized services or products, quantities, rates.

- Contact information: For any queries.

This clarity minimizes delays and disputes, directly impacting your cash flow positively. Many plugins also offer automated payment reminders, further encouraging prompt payment.

Meeting Legal and Tax Compliance Requirements

Invoices serve as legal documents for both you and your clients. They are essential for tax purposes, providing proof of income and expenses. Depending on your region and business type, there may be specific legal requirements for what an invoice must include, such as tax identification numbers, specific tax rates, or unique invoice numbers. A professional invoicing plugin helps ensure your documents meet these standards, keeping you compliant and avoiding potential legal issues.

Choosing the Best WordPress Plugin for Invoice Generation

With numerous options available, how do you select the ideal WordPress plugin to create professional invoice on WordPress? The right choice depends on your specific business needs, budget, and technical comfort level. Consider these factors when making your decision.

Evaluating Free vs. Premium Options

WordPress offers a range of invoicing plugins, from completely free solutions to feature-rich premium versions.

- Free Plugins: Often provide basic functionality like invoice creation, PDF generation, and simple client management. They are a great starting point for small businesses or those with straightforward billing needs. However, they might lack advanced customization, support, or integration options.

- Premium Plugins: Typically offer a more comprehensive suite of features, including advanced customization, automated recurring invoices, payment gateway integrations, detailed reporting, and dedicated customer support. While they come with a cost, the time savings and added functionality can justify the investment for growing businesses.

It’s often wise to start with a free version or a trial of a premium plugin to test its core features before committing.

Essential Features for Your Business Needs

Before choosing, list the features that are non-negotiable for your business. Here are some common and highly useful features to look for:

- Invoice Creation & Management: Easy generation, editing, and tracking of invoices.

- PDF Export: Ability to download and send invoices as professional PDF files.

- Customization: Options to add your logo, brand colors, and custom fields.

- Client Management: A database to store client information for quick invoicing.

- Product/Service Database: Store frequently billed items with their prices.

- Tax & Discount Management: Apply various tax rates and discounts easily.

- Payment Gateway Integration: Connects with popular payment processors like PayPal, Stripe, etc.

- Recurring Invoices: For subscription-based services or regular retainers.

- Reporting: Generate financial summaries and payment status reports.

Compatibility with Your Existing WordPress Setup

Ensure the plugin you choose is compatible with your current WordPress version, theme, and any other critical plugins you use (e.g., WooCommerce, CRM plugins). Incompatibility can lead to conflicts, errors, or even break your site. Always check the plugin’s documentation, user reviews, and last update date. A well-maintained plugin is more likely to be compatible and secure.

Step-by-Step Guide to Setting Up Your Invoice Plugin

Once you’ve chosen the right plugin to create professional invoice on WordPress, the next step is to get it up and running. The exact steps may vary slightly depending on the plugin, but the general process remains consistent.

Installing and Activating Your Chosen Plugin

The installation process for most WordPress plugins is straightforward:

- Navigate to Plugins: From your WordPress dashboard, go to Plugins > Add New.

- Search for the Plugin: Use the search bar to find your chosen invoicing plugin (e.g., “WooCommerce PDF Invoices & Packing Slips,” “WP Invoice,” “SlickQuiz”).

- Install: Click the “Install Now” button next to the plugin.

- Activate: Once installed, click “Activate.”

If you’ve purchased a premium plugin, you’ll typically download a .zip file from the developer’s website. You can then upload this file via Plugins > Add New > Upload Plugin and proceed with activation.

Configuring Basic Settings and Company Details

After activation, most plugins will add a new menu item to your WordPress dashboard (e.g., “Invoices,” “Billing,” or a sub-menu under WooCommerce). Click on this to access the plugin’s settings. Here, you’ll typically configure:

- Company Information: Your business name, address, contact details, and tax identification number.

- Currency Settings: Your preferred currency symbol and format.

- Invoice Numbering: Set up a sequential numbering system for your invoices.

- Default Payment Terms: Specify standard due dates (e.g., “Net 30”).

- Email Settings: Configure the sender email address for invoices and notifications.

Take your time to fill out these details accurately, as they will appear on all your generated invoices.

Adding Products, Services, and Client Information

To efficiently create professional invoice on WordPress, you’ll want to populate your plugin with your common products, services, and client data:

- Products/Services: Most plugins allow you to create a database of your offerings. For each item, you can add a name, description, unit price, and applicable tax rates. This saves time by allowing you to select items from a dropdown when creating new invoices.

- Client Information: Input your client’s names, addresses, contact details, and any specific billing preferences. Some plugins integrate with your existing WordPress user base or WooCommerce customer list, making this process even smoother.

Having this information pre-configured will significantly speed up the invoice creation process and reduce the chance of errors.

Customizing Your WordPress Invoices for Brand Consistency

A generic invoice template might get the job done, but a customized one elevates your brand. Making your invoices visually consistent with your website and other marketing materials is a key step to create professional invoice on WordPress.

Incorporating Your Logo and Brand Colors

Your logo is the cornerstone of your brand identity. Ensure your invoicing plugin allows you to easily upload your company logo, which will then appear prominently on all your invoices. Beyond the logo, look for options to adjust colors to match your brand palette. This might include changing the color of headings, lines, or accent elements on the invoice. Consistent branding across all touchpoints, including invoices, reinforces your professional image.

Designing Professional Layouts and Templates

Many invoicing plugins come with several pre-designed templates. Explore these options to find a layout that best suits your business type and aesthetic. A good template should be clean, easy to read, and logically organized. Key elements to consider in a layout include:

- Header: Clearly displays your logo and company information.

- Client Details: Prominently shows who the invoice is for.

- Invoice Details: Invoice number, date, due date.

- Itemized List: A clear table of services/products, quantities, rates, and totals.

- Subtotal, Tax, Total: Clearly broken down.

- Payment Instructions: How and where to send payment.

- Footer: Any additional notes or legal disclaimers.

Some advanced plugins offer drag-and-drop builders, giving you complete control over the invoice structure.

Adding Custom Fields and Payment Instructions

Every business has unique needs. The ability to add custom fields to your invoices can be incredibly useful. This might include fields for:

- Project numbers or reference codes: For internal tracking.

- Purchase order numbers: If your clients require them.

- Specific terms and conditions: Relevant to a particular service.

- Personalized notes: A thank you message or specific instructions.

Crucially, ensure your payment instructions are crystal clear. This includes accepted payment methods (e.g., bank transfer, credit card, PayPal), bank account details if applicable, and any specific instructions for online payments. The easier you make it for clients to pay, the faster you’ll receive your funds.

Automating Invoice Creation and Payment Reminders on WordPress

Automation is a game-changer for efficiency, especially when you create professional invoice on WordPress. It saves time, reduces manual errors, and ensures a consistent billing cycle, allowing you to focus on core business activities.

Setting Up Automatic Invoice Generation

For businesses with recurring services or subscriptions, manual invoice creation can be a significant drain on resources. Many WordPress invoicing plugins offer robust automation features:

- Recurring Invoices: Set up invoices to be automatically generated and sent on a predefined schedule (e.g., weekly, monthly, quarterly, annually). You define the service, client, amount, and frequency once, and the plugin handles the rest.

- Event-Triggered Invoices: For WooCommerce stores, invoices can be automatically generated upon order completion, payment confirmation, or when an order status changes. This ensures every sale has a corresponding invoice without manual intervention.

This feature is particularly beneficial for agencies, SaaS businesses, or anyone offering retainer services, ensuring a steady and predictable billing process.

Scheduling Payment Due Dates and Reminders

Getting paid on time is critical for cash flow. Automation extends to managing payment due dates and sending reminders:

- Automatic Due Dates: Configure your plugin to automatically calculate the due date based on your set payment terms (e.g., 7, 15, or 30 days from the invoice date).

- Automated Reminders: Set up a series of email reminders to be sent to clients before the due date, on the due date, and if the invoice becomes overdue. This gentle nudge can significantly reduce late payments without you having to manually track each invoice.

These automated reminders are polite, professional, and highly effective in maintaining healthy cash flow.

Integrating with Payment Gateways for Seamless Transactions

The final step in a smooth billing process is making it easy for clients to pay. Integrating your invoicing plugin with popular payment gateways allows clients to pay directly from the invoice itself, often with just a few clicks. Common integrations include:

- PayPal: A widely recognized and trusted online payment solution.

- Stripe: Popular for credit card processing, offering a seamless checkout experience.

- Other Local Gateways: Depending on your region, plugins may support local payment methods.

When a client clicks a “Pay Now” button on their invoice, they are directed to a secure payment portal. Once payment is made, many plugins can automatically mark the invoice as paid, further streamlining your financial management.

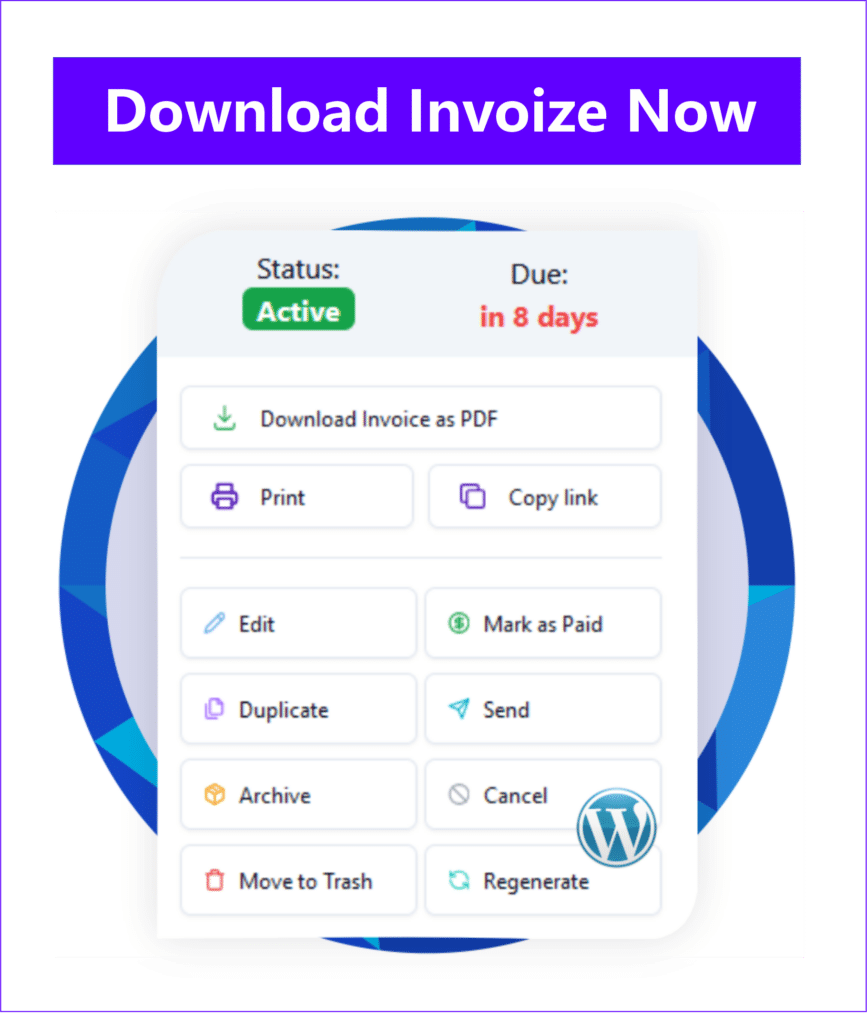

Managing and Tracking Your Invoices Directly from WordPress

Creating and sending invoices is only half the battle; effective management and tracking are essential for financial health. A good WordPress invoicing solution provides a centralized hub to oversee all your billing activities.

Viewing and Organizing All Sent Invoices

Your plugin should offer a clear, intuitive interface within your WordPress dashboard where you can view a comprehensive list of all invoices you’ve generated. This list typically allows you to:

- Filter: By client, date range, status (paid, unpaid, overdue, partially paid).

- Search: Quickly find specific invoices by number or client name.

- Sort: Arrange invoices by date, amount, or status.

This centralized view makes it easy to quickly find any invoice, resend it, or check its current status without sifting through emails or external files.

Marking Invoices as Paid or Partially Paid

When payments come in, you need a simple way to update the invoice status. Most plugins allow you to manually mark an invoice as “Paid” or “Partially Paid.” If you’ve integrated with payment gateways, this process can often be automated, with the plugin updating the status as soon as a payment is successfully processed. For partial payments, the system should track the remaining balance due, ensuring you always have an accurate picture of what’s owed.

Generating Reports for Financial Analysis

One of the most powerful features of a robust invoicing plugin is its reporting capability. These reports provide valuable insights into your business’s financial performance. You can typically generate reports on:

- Total Revenue: Over specific periods.

- Outstanding Balances: Who owes you money and how much.

- Paid vs. Unpaid Invoices: A breakdown of your billing efficiency.

- Tax Summaries: Essential for tax filing.

- Client-Specific Reports: To see a client’s billing history.

These reports are crucial for budgeting, forecasting, and making informed business decisions. They eliminate the need for manual data compilation, saving significant time and reducing the risk of errors.

Key Features to Look for in a WordPress Invoicing Solution

While basic invoice creation is a must, certain advanced features can significantly enhance your workflow and business capabilities when you create professional invoice on WordPress.

Multi-currency and Tax Support

If your business serves international clients or operates in regions with complex tax structures, multi-currency and robust tax support are indispensable. A good plugin will allow you to:

- Issue invoices in different currencies: Automatically converting rates or allowing manual input.

- Apply various tax rates: Based on product, service, or client location.

- Handle tax exemptions: For specific clients or services.

This ensures compliance and accuracy, regardless of where your clients are located or the tax regulations you need to follow.

Export Options for Accounting Software

Seamless integration with your existing accounting software (like QuickBooks, Xero, or FreshBooks) can save countless hours of manual data entry. Look for plugins that offer:

- CSV or XML Export: To easily transfer invoice data.

- Direct API Integration: For real-time synchronization with popular accounting platforms.

This feature ensures your financial data is consistent across all your systems, simplifying reconciliation and financial reporting.

Client Portal Functionality

A client portal is a dedicated, secure area where your clients can log in to view their invoices, payment history, and make payments directly. This self-service option offers several benefits:

- Improved Client Experience: Clients have 24/7 access to their billing information.

- Reduced Support Queries: Clients can find answers to common billing questions themselves.

- Faster Payments: Easy access to invoices and payment options encourages prompt payment.

For businesses with a large client base, a client portal can significantly enhance efficiency and client satisfaction.

Key Takeaways & Next Steps

The ability to create professional invoice on WordPress is no longer a luxury but a necessity for any serious online business. It streamlines your financial operations, enhances your brand image, and ensures a healthy cash flow. By choosing the right plugin and leveraging its features, you can transform your billing process from a tedious chore into an efficient, automated system.

Next Steps:

- Assess Your Needs: Determine your specific invoicing requirements, including budget, features, and desired level of automation.

- Research Plugins: Explore popular and highly-rated WordPress invoicing plugins, paying attention to reviews and feature sets.

- Start Simple: Begin with a free version or a trial to get comfortable with the plugin’s interface and core functionalities.

- Customize & Automate: Once comfortable, invest time in customizing templates and setting up automation for recurring invoices and payment reminders.

- Monitor & Optimize: Regularly review your invoicing process and reports to identify areas for further improvement and ensure smooth financial operations.

Embrace the power of WordPress invoicing to professionalize your billing, save time, and keep your business thriving.

The Critical Role of Professional Invoicing in Your Business

In the fast-paced world of business, a professional invoice is far more than just a request for payment; it’s a crucial document that reflects your brand’s professionalism, ensures healthy cash flow, and maintains clear financial records. Sending well-structured, clear, and timely invoices is paramount for several reasons. Firstly, it builds trust and credibility with your clients, showing that you operate with precision and attention to detail. Secondly, it’s fundamental for accurate accounting, tax compliance, and financial forecasting. Without a streamlined invoicing process, businesses risk delayed payments, disputes, and a disorganized financial overview, all of which can severely impact profitability and growth. Manual invoicing, while seemingly straightforward, often leads to errors, wasted time, and a lack of consistency, making a robust, automated solution essential for modern enterprises.

Key Takeaways & Next Steps

- Professionalism Matters: Invoices are a direct reflection of your business’s image.

- Cash Flow is King: Timely and accurate invoices are vital for financial health.

- Compliance & Records: Essential for legal, tax, and accounting purposes.

- Next Step: Explore how WordPress can transform your invoicing process from a chore into a strategic asset.

Harnessing WordPress Plugins for Efficient Billing

WordPress, renowned for its flexibility and extensive plugin ecosystem, offers an incredibly powerful platform for managing your business’s invoicing needs. Instead of relying on generic templates or external software that might not integrate seamlessly with your existing website, WordPress allows you to centralize your operations. Dedicated invoicing plugins empower you to create, send, and manage invoices directly from your WordPress dashboard, providing a cohesive and efficient workflow. These plugins eliminate the need for manual data entry across multiple systems, reducing errors and saving valuable time. From small freelancers to growing agencies, leveraging WordPress for invoicing means you can maintain brand consistency, automate repetitive tasks, and gain better control over your financial transactions, all within an environment you already know and trust.

Key Takeaways & Next Steps

- Centralized Management: Handle invoices directly within your WordPress site.

- Efficiency & Automation: Reduce manual effort and potential errors.

- Seamless Integration: Leverage your existing WordPress setup for billing.

- Next Step: Understand what features are critical when selecting the right invoicing plugin for your specific business needs.

Essential Features for Your Ideal Invoicing Solution

Choosing the right WordPress invoicing plugin is crucial for optimizing your billing process. To ensure you select a solution that truly meets your business needs, consider a few key features. Firstly, look for extensive customization options for invoice templates, allowing you to brand your invoices with your logo, colors, and specific terms. Secondly, seamless integration with popular payment gateways (like Stripe, PayPal, or Square) is non-negotiable for facilitating quick and easy payments. Recurring invoice capabilities are vital for subscription-based services or retainer clients, automating the billing cycle. Additionally, robust tax management features, multi-currency support, and the ability to generate detailed financial reports are essential for compliance and informed decision-making. Finally, a user-friendly interface and excellent customer support will ensure a smooth experience as you integrate the system into your daily operations.

Key Takeaways & Next Steps

- Customization: Brand your invoices to reflect your business identity.

- Payment Integration: Ensure compatibility with preferred payment gateways.

- Automation: Look for recurring invoices and automated reminders.

- Reporting & Compliance: Essential for financial oversight and tax purposes.

- Next Step: Prepare to implement your chosen plugin and establish best practices for ongoing success.

Implementing and Optimizing Your WordPress Invoicing System

Once you’ve selected your ideal WordPress invoicing plugin, the next step is to implement it effectively and establish best practices for ongoing success. Begin by installing and activating the plugin, then navigate through its settings to configure your business details, tax rates, and preferred payment gateways. Take the time to customize your invoice templates, ensuring they align perfectly with your brand’s aesthetic and include all necessary legal and payment information. When creating invoices, be meticulous: clearly itemize services or products, specify payment terms, and set due dates. Automate payment reminders to gently nudge clients, reducing late payments. Regularly review your generated reports to track outstanding invoices, analyze payment trends, and identify any bottlenecks in your billing cycle. This proactive approach not only keeps your finances in order but also provides valuable insight into your business’s financial health, allowing you to make data-driven decision

Key Takeaways & Next Steps

- Setup & Customization: Configure settings and brand your invoice templates.

- Accuracy & Clarity: Ensure all invoice details are precise and easy to understand.

- Automation: Utilize reminders and recurring invoices to streamline processes.

- Monitoring & Reporting: Regularly review financial data for insights and improvements.

- Next Step: Continuously refine your invoicing workflow and leverage reporting tools to identify areas for further improvement and ensure smooth financial operations.

Author

-

Hi, I'm Dede Nugroho. I enjoy sharing what I know with others. I'm passionate about security and have experience developing WordPress plugins

View all posts